Billing and tax invoice (agency)

Information in this guide may change depending on the country/region listed in your billing address. This article applies to Korea. For other countries/regions, please contact here for support.

Making a payment

Agencies can only pay by bank transfer.

•

Bank transfer: You need to add money to your account first to serve ads. If it is your first time to make a payment, please note that there is a minimum payment of 1 million KRW (VAT exclusive). Once you make the payment, Dable will check the amount and add it to your account. There can be delays in this process if you added money during weekends or holidays. To see Dable’s business license and bankbook, please go to the Marketing dashboard and click ‘Payment History’ under ‘Billing’.

Allocating budget to accounts

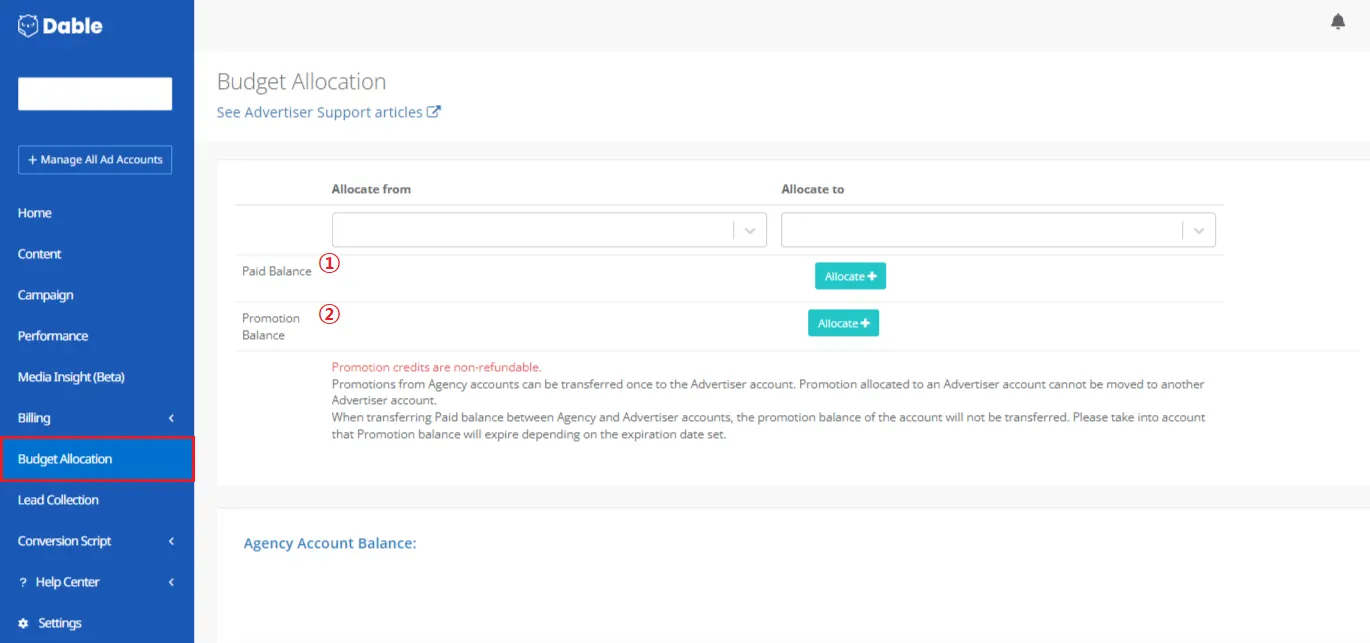

When an agency makes a payment, it will be added to the agency’s account. Then the agency will allocate this budget to each advertiser’s account as needed.

① Paid Balance: Balance that has been paid for by the Agency

② Promotion Balance: Promotion that has been provided by Dable.

•

Marketing dashboard – ‘Budget Allocation’ – Choose the account and type of Balance you wish to allocate under ‘Allocate to’ – Click ‘Allocate’

◦

NOTE: Promotions will expire automatically after (or before) 90 days from the point of promotion top-up (depending on the terms agreed with your Dable representative). Please take note of this when allocating Promotions to Advertiser accounts.

Tax Invoice

Once you pay for your ads (considering your commission payment option), we will check and add it to your account. We will also issue tax invoice by using the business info you have provided in your account.

FAQ

I want to change my business registration info/tax invoice info.

What is Invalid Click Adjustments?

Can I allocate promotional credits to another advertiser account?

I’m an agency, but can I let my advertiser pay for his ad by himself?